Perry still used his influence to force the reduction in property taxes and with that created an ongoing structural deficit in the Texas budget. We know he was a poor student. We know he was a poor legislator. We know he is a terrible and fiscally irresponsible governor. Do we want to risk that this will become our President? Really?

How Rick Perry Created His State’s $27 Billion Budget Crisis

By Lou Dubose, The Washington Spectator

27 August 11

He Was Warned

“As of this moment, this legislation is a staggering $23 billion short of the funds needed to pay for the promised property tax cuts over the next five years…. These are conservative estimates.”

– Texas Comptroller Carole Strayhorn, warning Gov. Rick Perry about his 2006 tax reform proposal

N HIS STATE OF THE STATE SPEECH in February, Rick Perry described the $27 billion budget shortfall confronting the Texas Legislature.

Now, the mainstream media and big government interest groups are doing their best to convince us that we’re facing a budget Armageddon,” Perry said. “Texans don’t believe it and they shouldn’t because it’s not true.” The $27 billion equaled 15 percent of the $182 billion biennial budget the Legislature had passed two years earlier. If not Armageddon, an apocalyptic loss of revenue in a low-tax state that provides bare-bones public services.

Perry’s statement was even more remarkable because most of the budget shortfall was a consequence of a business-tax bill he pushed through the Legislature in a special session five years earlier.

With Perry running for president on a record of fiscal responsibility (and job creation, discussed later in this article), it’s important to understand the consequences of his 2006 “business margins tax” – and to ask if the governor knew that the tax reform he proposed would undermine the state’s budgets in the years that followed.

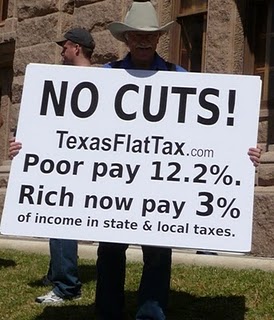

First, some background. Texas is one of nine states with no income tax. It relies on property taxes to pay for public services – notably, to pay for public education, which consumes the lion’s share of property taxes.

Because there is no income tax, property taxes are high. In 2006, Perry called a special session to address property taxes. With no income tax, there are no easy fixes. Yet Perry found one. A business-margins tax he said would provide enough revenue to allow for reductions in property taxes.

How Rick Perry Created His State’s $27 Billion Budget Crisis