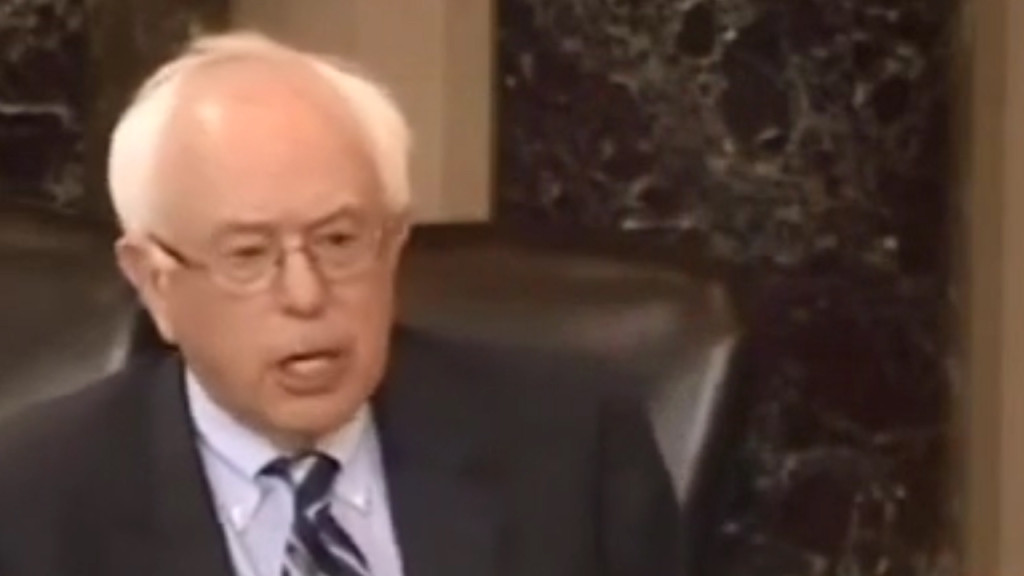

The Bernie Sanders message continues to coalesce with reality

Bernie Sanders turned out to be right again. The following snippet from IBT is prescient.

Soon after taking office in 2009, Obama and his secretary of state — who is currently the Democratic presidential front-runner — began pushing for the passage of stalled free trade agreements (FTAs) with Panama, Colombia and South Korea that opponents said would make it more difficult to crack down on Panama’s very low income tax rate, banking secrecy laws and history of noncooperation with foreign partners.

Even while Obama championed his commitment to raise taxes on the wealthy, he pursued and eventually signed the Panama agreement in 2011. Upon Congress ratifying the pact, Clinton issued a statement lauding the agreement, saying it and other deals with Colombia and South Korea “will make it easier for American companies to sell their products.” She added: “The Obama administration is constantly working to deepen our economic engagement throughout the world, and these agreements are an example of that commitment.”

Critics, however, said the pact would make it easier for rich Americans and corporations to set up offshore corporations and bank accounts and avoid paying many taxes altogether.

“A tax haven … has one of three characteristics: It has no income tax or a very low-rate income tax; it has bank secrecy laws; and it has a history of noncooperation with other countries on exchanging information about tax matters,” Rebecca Wilkins, a senior counsel with Citizens for Tax Justice, a nonpartisan nonprofit that advocates changes in U.S. tax policy, told the Huffington Post in 2011. “Panama has all three of those. … They’re probably the worst.”

Bernie Sanders went to the floor of the Senate in 2011 and said the following.

“Finally, Mr. President, let’s talk about the Panama Free Trade Agreement.

Panama’s entire annual economic output is only $26.7 billion a year, or about two-tenths of one percent of the U.S. economy. No-one can legitimately make the claim that approving this free trade agreement will significantly increase American jobs.

Then, why would we be considering a stand-alone free trade agreement with this country?

Well, it turns out that Panama is a world leader when it comes to allowing wealthy Americans and large corporations to evade U.S. taxes by stashing their cash in off-shore tax havens. And, the Panama Free Trade Agreement would make this bad situation much worse.

Each and every year, the wealthy and large corporations evade $100 billion in U.S. taxes through abusive and illegal offshore tax havens in Panama and other countries.

According to Citizens for Tax Justice, “A tax haven . . . has one of three characteristics: It has no income tax or a very low-rate income tax; it has bank secrecy laws; and it has a history of non-cooperation with other countries on exchanging information about tax matters. Panama has all three of those. … They’re probably the worst.”

Mr. President, the trade agreement with Panama would effectively bar the U.S. from cracking down on illegal and abusive offshore tax havens in Panama. In fact, combating tax haven abuse in Panama would be a violation of this free trade agreement, exposing the U.S. to fines from international authorities.

In 2008, the Government Accountability Office said that 17 of the 100 largest American companies were operating a total of 42 subsidiaries in Panama. This free trade agreement would make it easier for the wealthy and large corporations to avoid paying U.S. taxes and it must be defeated. At a time when we have a record-breaking $14.7 trillion national debt and an unsustainable federal deficit, the last thing that we should be doing is making it easier for the wealthiest people and most profitable corporations in this country to avoid paying their fair share in taxes by setting-up offshore tax havens in Panama.

Adding insult to injury, Mr. President, the Panama FTA would require the United States to waive Buy America requirements for procurement bids from thousands of foreign firms, including many Chinese firms, incorporated in this major tax haven. That may make sense to China, it does not make sense to me.

Finally, Panama is also listed by the State Department as a major venue for Mexican and Colombian drug cartel money laundering. Should we be rewarding this country with a free trade agreement? I think the answer should be a resounding no.”

It seems once again the establishment sold its soul at the expense of the American taxpayers. Of course, we all knew this. The evidence will be forthcoming as more of the leak is examined.