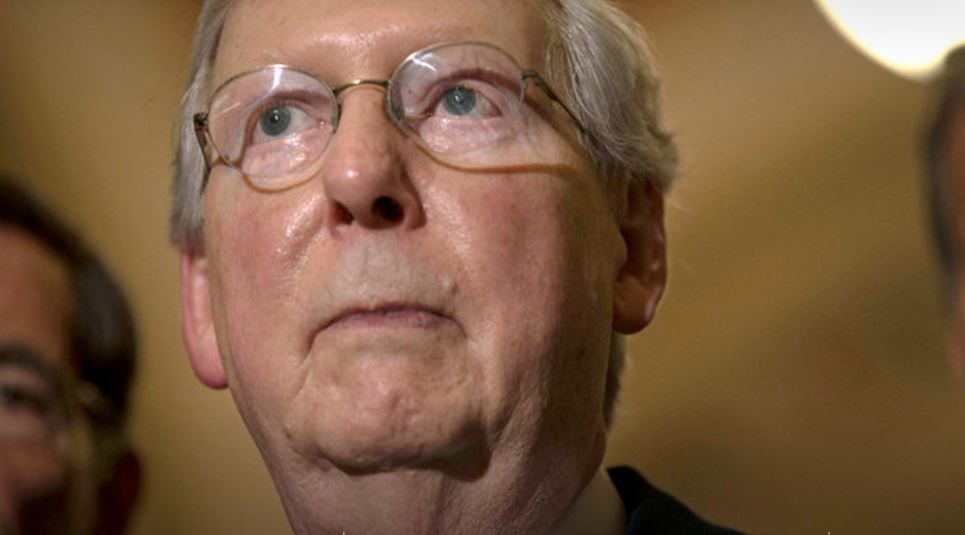

Senate Majority Leader Mitch McConnell release the so called Skinny Repeal Bill in the Republicans’ attempt to repeal the Affordable Care Act.

The Skinny Repeal Bill language is here. Many Republicans say they do not want it but will vote for it if Paul Ryan promises a conference.

According to the New York Times,

Senator Mitch McConnell, the majority leader, pulled in his sails on repealing the Affordable Care Act, and unveiled a more narrow measure that would:

- REPEAL THE INDIVIDUAL MANDATE, which says that most Americans must have health insurance or pay a tax penalty.

- REPEAL THE EMPLOYER MANDATE, which requires large employers to offer health insurance to their workers.

- GIVE FLEXIBILITY TO STATES, making it much easier for them to waive federal requirements that health plans provide consumers with a minimum set of benefits like maternity care and prescription drugs.

- EXPAND HEALTH SAVINGS ACCOUNTS, increasing the limit on contributions to such tax-favored accounts

- DELAY A TAX ON MEDICAL DEVICES.

- INCREASE FUNDS FOR COMMUNITY HEALTH CENTERS.

The insurance lobby has warned Republicans that the Skinny Repeal Bill will have adverse effects on the individual insurance market.

AHIP has addressed a letter to Senate leaders, calling for short-term stability and longer-term improvements in the individual health insurance market and emphasizing that the deadline is rapidly approaching for insurers to make final decisions about their premiums and participation for 2018.

Our letter states: “The mid-August deadline for finalizing 2018 premiums is rapidly approaching, yet significant uncertainties remain. This continued uncertainty – combined with targeted proposals that would eliminate key elements of current law without new stabilizing solutions – will not solve the problems in the individual market, and in fact will result in higher premiums, fewer choices for consumers, and fewer people covered next year. We would oppose an approach that eliminates the individual coverage requirement, does not offer alternative continuous coverage solutions, and does not include measures to immediately stabilize the individual market.”

We urge Congress to take action now on the following priorities:

- Consumers’ cost-sharing reduction benefit, which low- and modest-income families depend on to afford their out-of-pocket medical costs, must be appropriately funded, or premiums will rise by about 20 percent.

- The health insurance tax should be eliminated, so that premiums do not increase by 3 percent, which would cost hundreds of additional dollars per year for millions of Americans beginning in 2018, including seniors and small business owners, as well as states.

- Individuals with pre-existing medical conditions should be covered and protected, and those protections must be coupled with either the individual coverage requirement or other continuous coverage solutions. Eliminating the individual coverage requirement by itself will likely result in fewer people covered and a deterioration of the risk pool, which will increase premiums.

- A mechanism to stabilize the exchanges should be established for 2018-2019, to support care for people with serious health conditions and put downward pressure on premiums for everyone.