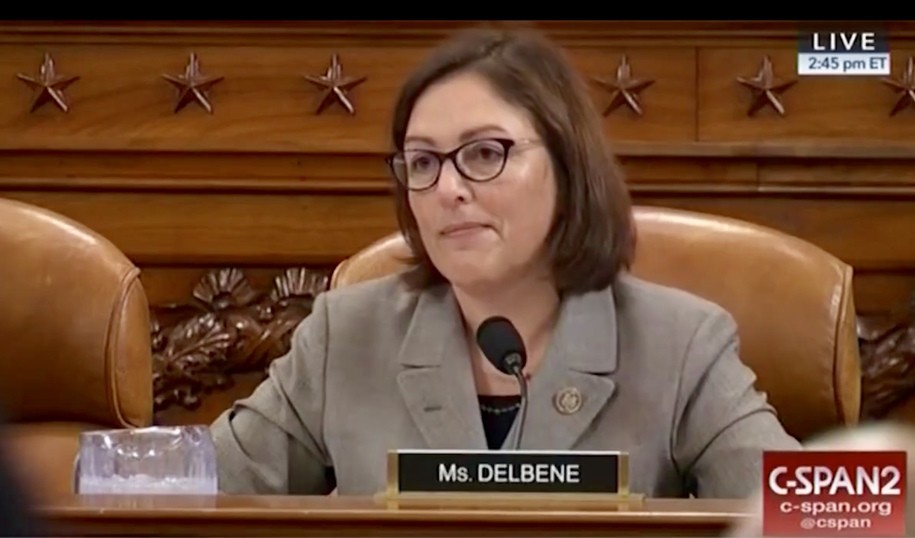

Congressman Mark Takano posted the most riveting video snippet in which Congresswoman Suzan DelBene proved beyond the shadow of a doubt that the Republican Tax Cut Scam purposefully pilfers middle-class Americans. She showed it takes away tax relief from Americans while giving them to corporations.

Congressman Mark Takano wrote the following.

This remarkable line of questioning from Congresswoman Suzan DelBene demonstrates just a few of the ways that the GOP tax plan treats corporations better than people.

Under the Republican plan, corporations are still allowed to deduct state and local taxes. Workers are not. Corporations are still allowed to deduct business expenses. Teachers are not.

Corporations are still allowed to deduct more than $10,000 in property taxes. Homeowners are not. Corporations are still allowed to deduct moving expenses. Families are not.

And this is on top of a $1.5 trillion corporate tax cut.

Let’s be clear, this is not a “middle-class tax cut.” Working families get the crumbs and the super-wealthy get everything else.

Recently, John Harwood, a far cry from a Liberal or Progressive reporter appeared on MSNBC with Ali Velshi and slammed the Republican Tax Cut Scam in the journalistic kind of way that was very evident. He also pointed out an unfortunate truth you must point out to every Republican & Trump supporter.

Daily Kos Leslie Salzillo captured the essence of the interrogation.

DelBene: A few questions: Will a teacher in my district who buys pens, pencils, paper for his students be able to deduct these costs from his tax plan under this plan?

GOP: Uh, H.R. 1 would repeal the above the line deduction for teacher expenses.

DelBene: Will a corporation that buys pens, pencils and paper from its workers be able to deduct those costs from its tax returns under this plan?

GOP: Uh, the general deduction for ordinary and necessary business expenses by any business entity is not changed. It need not be…

DelBene: So they would.

Yes, they would. Simply put, under the new GOP plan, corporations would be able to deduct business expenses, yet teachers who continue to be underpaid and who are sometimes the biggest influence in a child’s life—will simply have to eat the expenses he/she incurs in order to help educate our children.

The GOP can spin it however they want, but the Republican tax plan/scam only benefits the rich and takes more away from those most in need.