The Republican tax cut scam will only fail if everyday Americans speak up in their own words. Politicians must realize that they are not pulling the wool over our heads. Once they know Americans understand they are being screwed they some will think twice about their survival. So, dear readers, I have a task for you.

One of my friends posted the following Facebook post about the Republican tax cut scam.

Why I oppose the Republican Tax Cut Scam

I think we need to simplify the tax code. We shouldn’t have to hire someone to help us pay our taxes. That said, I oppose the current tax reform bill for two major reasons.

From the 1930’s to the 1970’s, the way America kept the economy strong was by investing in education, research, and infrastructure. The belief was that by having the best transportation system, the best schools, and the best science, we could also have the best economy in the world. Furthermore, by spending on these programs, we would create lots of jobs in construction, education, and so forth. This was considered a worthwhile endeavor, even if it meant high taxes on the rich, and during the 1950’s, the richest Americans paid up to 94% in taxes because of this.

From the 1980’s to the present, we have taken the philosophy that low taxes on the rich is the best way to create jobs. I would argue that we can just look at the results and see that the economic policies of the 1950s worked better than the economic policies today, but its even more basic than that. This philosophy of tax cuts to the rich doesn’t work because the rich don’t spend money the same way the rest of us do. There is a myth that rich people create jobs, but that is simply not true. Customers create jobs. When more money is in the hands of working people, we go shopping, and when more people go shopping, businesses are forced to create jobs. When we give money to rich people, they invest it in things that give them money without regard to whether it helps the economy or not, and most times it doesn’t.

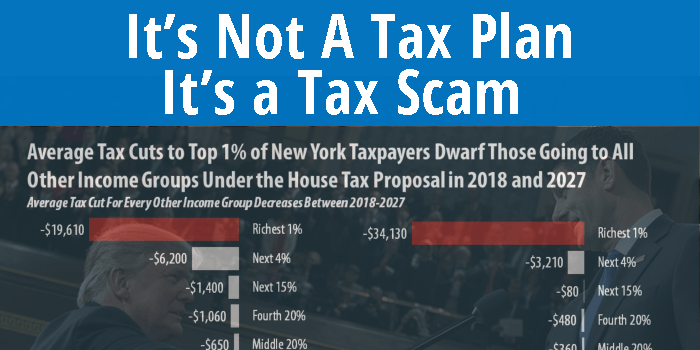

This tax bill gives huge tax cuts to the rich while cutting spending from programs that help the working class. In other words, this tax cut gives us more of the tax policy we have been following, which has failed us, since the 1980s and less of what we did back in the 1950’s and 60’s that we know actually worked. For the same reasons, this policy will only lead to bad results for everyone except a small group of the richest Americans.

Secondly, I oppose this bill because it will send America trillions of dollars more deeply in debt. Here are two general rules for the debt. 1. When the economy is bad, its okay to spend into debt in order to get the economy back up and running again. Its better to spend deeply into debt temporarily so that people get back to work because that investment pays for itself. 2. When the economy is doing well, we should do everything possible to make sure we are not spending ourselves deeper into debt. If we are spending ourselves into debt when the economy is good, we are saving nothing for when it is bad and we are passing on the bills to our children, which is morally wrong and will ultimately lead to destruction.

Right now our economy is strong. It crashed in 2007 and has built up ever since. We needed to spend into debt back around 2007-2010. We do not need to spend ourselves into debt today. Right now, we need to be figuring out how to get ourselves out of debt.

For these two reasons, I strongly oppose the current tax bill that is being debated in Congress.

I want to put together a sub-site with real letters from everyday Americans, you, detailing how the Republican tax cut scam will affect you, your family, or your friends. Include your first name, your city, and your state. Please send to info@egbertowillies.com. We will post and share creating an ever-growing people involvement project. Please remember to share so we can spread widely.

…