Dr. Lawrence Wittner (http://www.lawrenceswittner.com) is Professor of History emeritus at SUNY/Albany and the author of Confronting the Bomb (Stanford University Press).

The Rich

Whatever happened to the notion that rich people should pay their fair share of the cost for their country’s public programs?

Progressive income taxes―designed to fund government services and facilities—go back centuries, and are based on the idea that taxes should be levied most heavily on people with the ability to pay them. In the United States, the federal government introduced its first income tax in 1861, to cover the costs of the Civil War. Although new federal income tax legislation in the 1890s was ruled unconstitutional by the U.S. Supreme Court, the resulting public controversy led, in 1913, to passage of the sixteenth amendment to the Constitution, firmly establishing the legality of an income tax.

The progressive income tax―levied, at its inception, only on the wealthiest Americans―was a key demand and political success of the Populist and Progressive reformers of the late nineteenth and early twentieth centuries. As might be expected, most of the wealthy regarded it with intense hostility, especially as the substantial costs of World War I sent their tax rates soaring. The development of jobs programs and other public services during the New Deal, capped by the vast costs of World War II and the early Cold War, meant that, by the 1950s, although most Americans paid income taxes at a modest rate, the official tax rate for Americans with the highest incomes stood at about 91 percent.

Of course, the richest Americans didn’t actually pay at that rate, thanks to a variety of deductions, loopholes, and its application to only the highest increment of their income. Even so, like many of the wealthy throughout history, they deeply resented paying a portion of their income to benefit other people―people whom they often regarded as inferior to themselves. Consequently, cutting taxes for the rich became one of their top political priorities.

Facing a strong backlash from the wealthiest Americans, their corporations, and conservative politicians, the federal government began a retreat. In 1964, the top marginal tax rate was reduced to 70 percent, in 1982 to 50 percent, and, in 1988, to 28 percent. Although it was raised somewhat during the Clinton presidency, it was reduced again during the reign of George W. Bush.

The Trump-GOP tax cut of $1.5 trillion in December 2017 provided the latest payoff to the wealthy. It lowered the top tax rate, slashed the corporate tax rate from 35 to 21 percent, and doubled exemptions from the federal inheritance tax to $22 million per married couple. Although not all of the tax benefits went to the richest Americans, the vast bulk of them did. An estimated 83 percent of the households among America’s wealthiest one-tenth of 1 percent will receive a tax break, with an average benefit of $193,380 per year.

Why did Americans support this new raid upon the federal treasury that enriches the nation’s millionaires and billionaires?

Actually, they didn’t. A Gallup poll of April 2017 found that 63 percent of Americans believed that upper income people paid too little in taxes. That same month, the Pew Research Center reported that 60 percent of Americans were bothered “a lot” by the fact that “some wealthy people don’t pay their fair share” of taxes. In October 2017, a Reuters/Ipsos poll discovered that three-quarters of Americans thought that the wealthiest Americans should pay more in taxes. Furthermore, surveys taken at the time by U.S. polling agencies consistently found that public support for the regressive Trump-GOP tax legislation languished in the mid-20s.

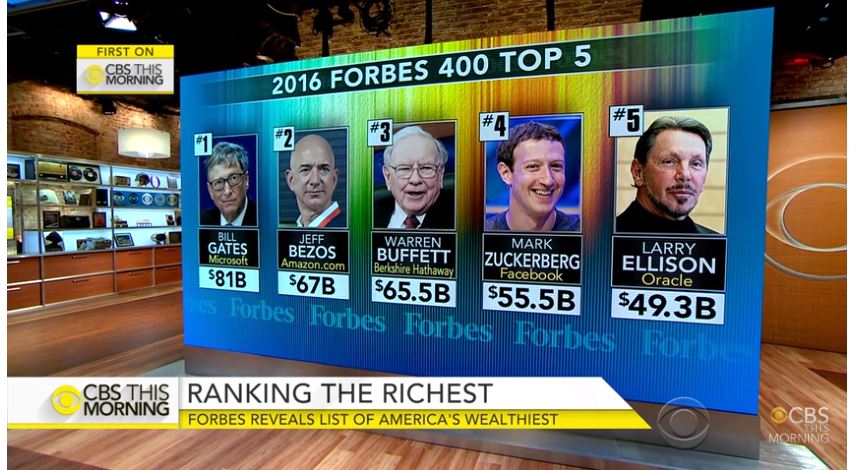

A key reason why most Americans favor taxing the rich is the traditional one: the wealthiest have the greatest ability to shoulder the nation’s tax burden. After all, America’s richest 1 percent now possess nearly 40 percent of the nation’s wealth―almost twice the wealth held by 90 percent of the public. Indeed, it’s hard to imagine why they need to add anything to the enormous wealth they have already amassed. For example, Charles and David Koch, heirs to a vast fortune and, currently, the leading champions of tax-cutting and other rightwing schemes, have a combined net wealth of $120 billion. If they simply stopped raking in additional income and, instead, each spent $1 million per day, they could continue doing that for over 164 years.

Conversely, nearly half of all American households cannot afford the basics of existence like food, housing, and medical care. Why should they be taxed heavily―or at all―to fund public facilities and services that the richest Americans, with their unprecedented wealth, can easily afford to cover?

Another reason to raise taxes on the rich is that it’s good for the economy. Of course, this contradicts the unverified contention of their cheerleaders that such taxation leads to job loss and economic collapse. But, in fact, as even some leading businessmen have pointed out, taxing the rich to fund public programs increases investment, boosts productivity, and creates more and better jobs. Following World War II, when the wealthiest Americans had a 91 percent tax rate and top federal tax rates on stock dividends ran between 70 and 90 percent, America experienced an enormous economic boom. Another surge of rapid economic growth occurred in the late 1990s, following federal tax hikes on wealthy investors. Only after President George W. Bush pushed through sharp cuts in taxes for the wealthy did the America economy slow and, then, collapse in the Great Recession.

Much the same pattern has emerged in the states. In 2012, Kansas slashed its tax rates, while California raised taxes on its wealthiest residents. Five years later, the Kansas economy was on life support, while California was undergoing the strongest economic growth in the nation.

Not surprisingly, states are turning increasingly to enacting a “millionaires tax,”and the Trump-GOP tax cuts for the rich have become a potential political liability for the Republicans in the 2018 congressional elections.