R.epublicans pilfered their own constituents and all Americans with their tax cut scam. They claimed it was a middle-class tax cut. But a new CBO report says that the budget deficit is exploding. Ironically, in the aggregate, individuals are paying $100+ billion dollars more and corporations $70+ Billion less.

Vox reported the following.

House Republicans on Monday unveiled “Tax Reform 2.0,” a new set of proposals to stack onto the tax legislation they passed in 2017. The proposals would make the individual tax cuts contained in last year’s legislation permanent — they were scheduled to expire after 2025.

Republican leaders had anticipated the tax cuts they passed in 2017 would be a big win with voters, but thus far, that hasn’t been the case. The new legislation package seems to be a sort of eleventh-hour effort by the GOP to sell voters on the tax reform effort.

The 2017 tax bill cut taxes for most Americans, including the middle class, but it heavily benefits the wealthy and corporations. It slashed the corporate tax rate from 35 percent to 21 percent, and its treatment of “pass-through” entities — companies organized as sole proprietorships, partnerships, LLCs, or S corporations — will translate to an estimated $17 billion in tax savings for millionaires this year. American corporations are showering their shareholders with stock buybacks this year, thanks in part to their tax savings.

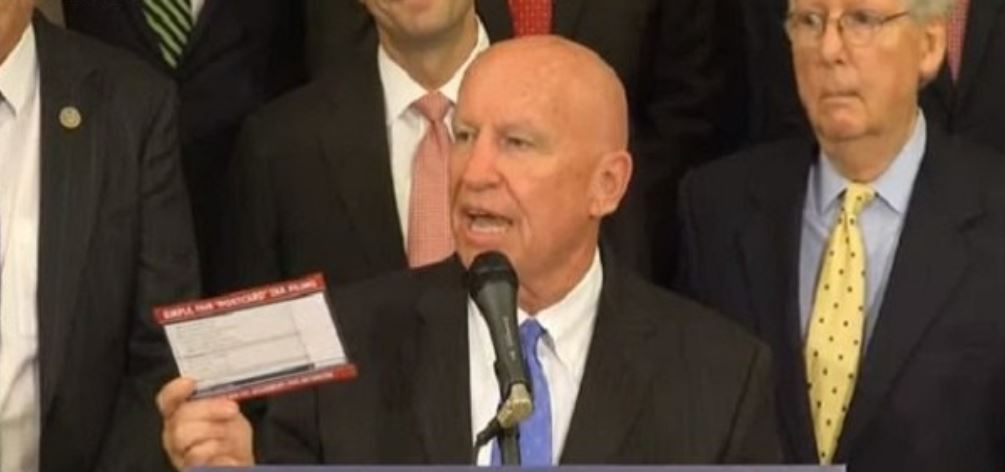

The new proposed package, announced by House Ways and Means Committee Chair Kevin Brady (R-TX) on Monday, seeks to make permanent individual tax cuts, small-business income deductions, and a larger child tax credit under the 2017 law that were set to expire after 2025. The legislation also contains a number of provisions aimed at boosting retirement savings and savings accounts for families and would make it easier for startups to write off their costs. The package initially consists of three bills sponsored by Republican Reps. Rodney Davis (IL), Mike Kelly (PA), and Vern Buchanan (FL).

The organization of millionaires, Patriotic Millionaires, who want to do the right thing release a Press Release that slammed Tax Reform 2.0.

On making cuts to individual tax rates permanent:

“Extending the cuts to individual tax rates isn’t a win for middle-class Americans. Congressional Republicans are dropping a few crumbs in front of the American public to distract from the fact that they’re robbing them blind. Just wait, Republicans are going to use these cuts later as an excuse to cut Medicare, Medicaid, Social Security, and other programs millions of Americans rely on.”

On making cuts for pass-through owners permanent:

“Thepass-through deduction is simply indefensible. If Republicans actually wanted to help small businesses there were 100 other ways they could have done it, but they chose the one way that happens to give a massive tax break to any millionaire or billionaire rich enough to hire an accountant to funnel their income through a shell company. Just 10% of people who claim pass-through income are actually small business employers, and half of them don’t conduct any business activity at all. Making this deduction permanent isn’t about helping small businesses, it’s about rewarding GOP donors and enriching the dozens of Republicans in Congress and the White House who personally benefit from the pass-through deduction.”

On making caps to the State and Local Tax (SALT) Deduction permanent:

“Capping the SALT deduction is a petty partisan attack on blue states that’s more about flexing Republican power than it is about actual tax policy. Republican Members of Congress from California, New Jersey, and New York should think twice before voting to raise taxes on their constituents just to make a point.”

On Universal Savings Accounts:

“Universal savings accounts aren’t designed to help normal Americans save, they’re built to give rich Americans another tax shelter. The rich are going to love the tax benefits of their universal savings accounts, but most Americans don’t make enough to take full advantage of these accounts, if they are able to use them at all. Even for people that do use them, USAs don’t help people save. Because the money in them is so much more accessible than funds in a 401k or Roth IRA, people are most likely to spend their money instead of saving it for retirement. Pushing these kinds of savings accounts isn’t just bad policy, it’s reckless and stupid.”

It is evident that Republicans have little respect for Americans. It is clear that this tax reform is robbing everyday Americans blind.