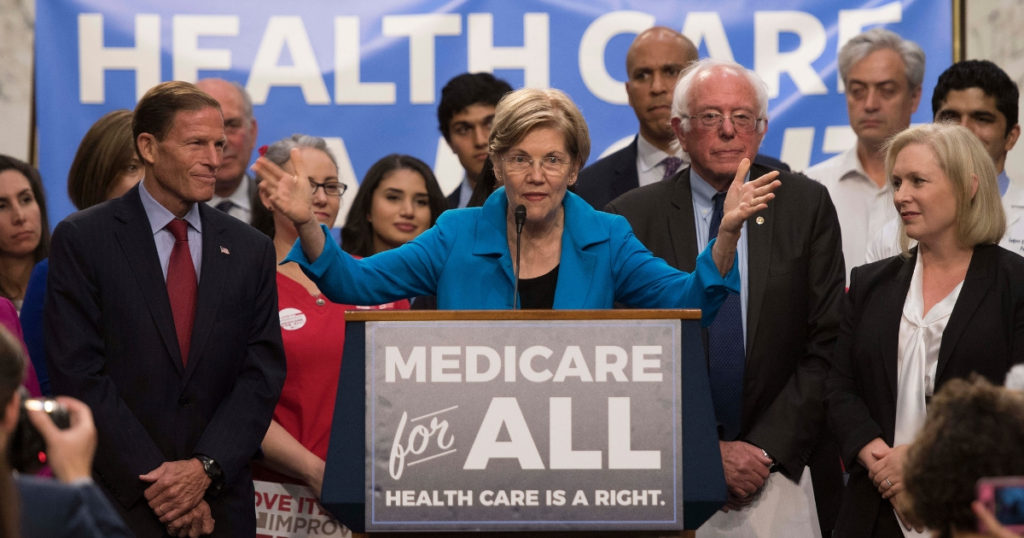

I got a call from a Politics Done Right listener who said he heard that Single-Payer Medicare for All would increase the taxes of most people and it would increase government expenditures. I told him that in fact, it would raise taxes for most but that is not the whole story. To be clear, every individual will be better off for precise reasons.

Single-Payer Medicare for All will increase taxes

Here is an absolute statement. If one entity is paying our medical bills, it is much more efficient than having multiple companies do it. Let’s say we have 100 health insurance companies. When you add that each company has to have its own executives, a board of directors, advertising budgets, capital costs, computer equipment, accountants, risk managers, and a myriad of other expenses, it illustrates what we actually see, expensive insurance. If there is one payer that covers everybody, Single-Payer Medicare for All, then all of those duplicated costs go away, and some functions are virtually unnecessary.

Private insurance companies also have shareholders. Shareholders demand dividends and ever-expanding stock appreciation at a higher rate than inflation or a higher rate than the expanding economy. That is one reason among many others why health insurance rates increase faster than inflation. This same issue applies to pharmaceutical companies who raise rates not to create better drugs but to ensure better value for their shareholders and corporate bonuses.

I gave the caller a hypothetical example for illustrative purposes to counter the fallacy that somehow Single-Payer Medicare for All is detrimental to the individual. The opposite is true. Again, the numbers I am using are just for illustrative purposes as the real numbers are dependent on the basic services that will form part of the new system.

A family making $50,000 may pay $5,000 in Federal Income Taxes and $12,000 in health insurance — that $12,000 goes to an insurance company. That insurance usually has anywhere from a $500 to $10,000 deductible. There are traditionally copays associated with it as well. So even with this insurance and level of payments, if one uses health care, they can still be relegated to bankruptcy. In effect, out of pocket expenditures for health care and taxes can leave little for all other standard household and living expenses.

Single-Payer Medicare for All simplifies everything and cost less in the aggregate. That same person would still pay that $5,000 in Federal Income Tax. They may then pay, who knows, $5,000 in health care taxes. The taxes would actually be progressive, meaning if you make less you pay less. If you make more, you pay more. Every single American would have access to health care without concern for deductibles. One could actually plan their life without the fear of worrying that if they get sick their entire outcome changes including the possibility of bankruptcy.

Some balk at this as being too utopian. Where is the money going to come from? First of all, doctors’ offices will no longer have to have large staffs to handle the fight with dozens of insurance companies. That means lower cost for office visits. Additional money comes from not having to pay shareholder dividends, overpriced executives, bonuses, and all the duplicate expenditures we spoke about earlier. But that is only the beginning.

As you move towards Single-Payer Medicare for All, we must start other reforms. It won’t be easy because all of the stakeholders, pharmaceutical companies, hospitals, etc. will fight to keep their cash cow.

Most drugs are not discovered or designed or invented by huge pharmaceuticals who continue to loot the middle-class. They are created with NIH grants at Universities and elsewhere. When it is time to formalize them as drugs for the masses, capitalists buy and then overcharge for these drugs. Ironically, the government, you the taxpayer who paid to develop the drugs in the first place, do not partake of the profits. Drug companies want large rewards, large profits, with no real risk. We must rein this in sooner rather than later.

Many doctors leave school with hundreds of thousands in debt. We must institute some sort of merit system that allows doctors to go to medical school for free and then pay it forward by dedicating some years in the public sector. We must regulate hospitals to prevent them from charging inordinate rates just because they think they can.

Our health care system needs a complete revamping. It is inefficient and immoral. We must first understand that capitalism and the market do not work in health care delivery. There are very specific reasons beyond the scope of this post why that is true. The transition must begin now. It must include support for all of those who will lose jobs as inefficiencies are extricated. But we must get started now.

Check out the entire episode here.