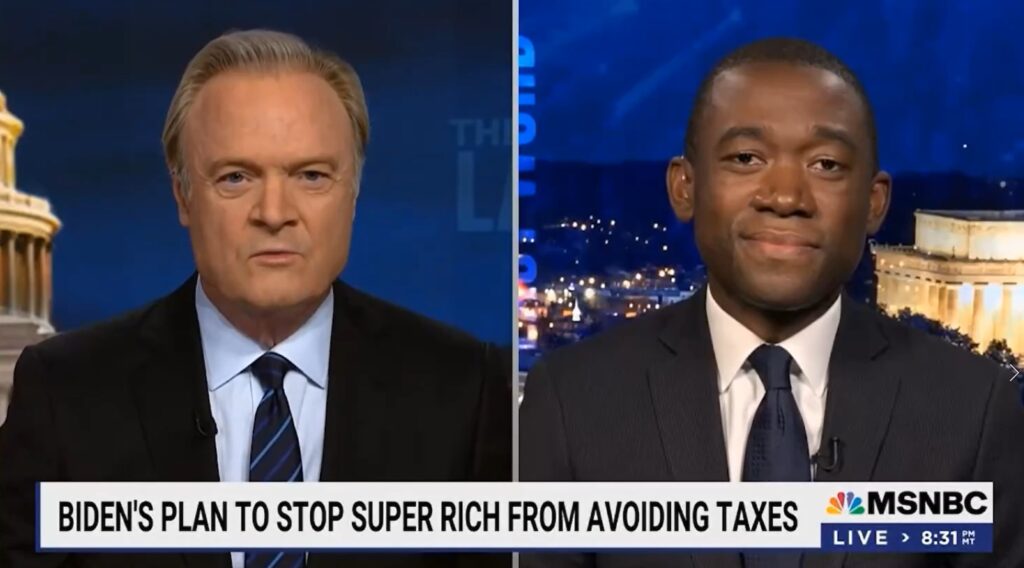

Biden’s Treasury Department Deputy Secretary Wally Adeyemo dispelled the hysteria of the IRS coming to review your every transaction. It’s false

Biden official calls out IRS falsehoods

Treasury Department Deputy Secretary Wally Adeyemo made it clear that the IRS will not be going after information in the average American’s bank accounts. They are looking for tax cheats. Rich people steal from the average American every year by not paying over $150 Billion in taxes. That money then has to be borrowed. We all then pay the interest and principal. It is more than welfare for the rich. It is theft because as they lend us back the money, that interest is theft.

So what are banks and other supporters of the rich thievery doing?

Banks and their trade groups are running advertising and letter-writing campaigns to raise awareness — and concern — about the proposal. As a result, banks from Denver to Philadelphia say they are being deluged with calls, emails and in-person complaints from both savers and small-business owners worried about the proposal. JPMorgan Chase & Company has issued talking points to bank tellers on what to tell angry customers who call or come into a branch to complain.

And of course, fearing the small number of rich more so than our large number of average Americans, what are the Democrats doing?

WASHINGTON — Senate Democrats on Tuesday, bowing to an aggressive lobbying campaign by the banking industry and pushback from Republicans, scaled back a Biden administration plan for the Internal Revenue Service to try to crack down on tax cheats.

The new proposal, which would help pay for the expansive social policy and climate change bill that includes it, narrows the scope of information that banks would have to provide to the I.R.S. about customer accounts. Under the revised plan, which is backed by the Biden administration, banks would be required to provide data on accounts only with total annual deposits or withdrawals worth more than $10,000, rather than the $600 threshold that was initially proposed. The reporting requirement would not apply to payroll deposits for wage and salary earners or to beneficiaries of federal programs such as Social Security.

The plan was narrowed after a steady lobbying campaign by banks and a barrage of criticism from Republicans, who argued that the administration’s desire to bolster the I.R.S. to shrink the $7 trillion “tax gap” amounted to an invasion of privacy and government overreach.

The rich, the biggest welfare recipients, continue to purchase that privilege.