The only reason we tolerate our economic system is that we are indoctrinated by economists into believing that ours is the best option. IT IS NOT!

Economists fail to open their eyes.

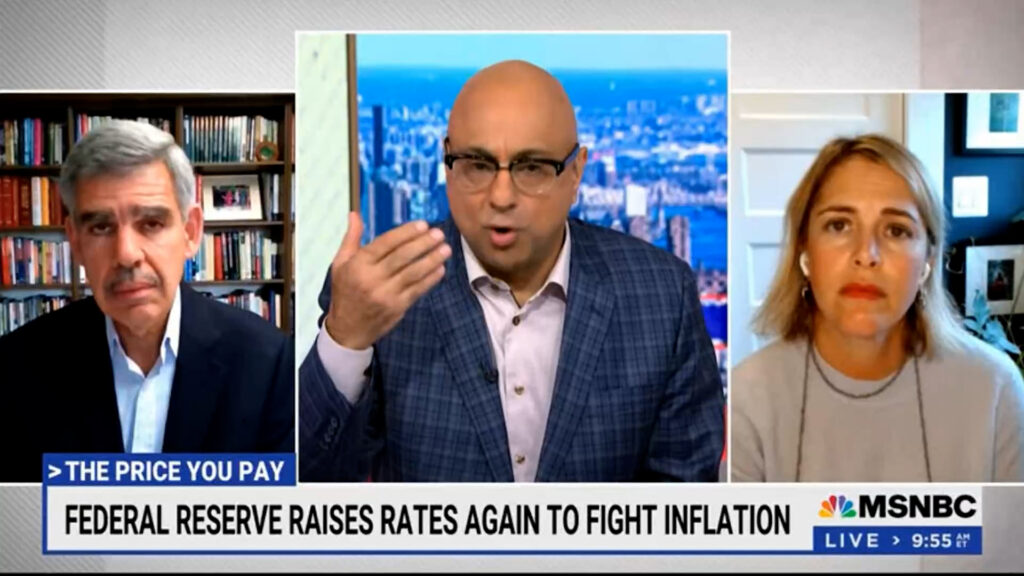

Many would listen to these two reputable economists speaking to Ali Velshi and assume that our economic system is immutable. They would have you believe that the economy follows some specific rule. We have a manipulated economy where the poor and middle-class are always asked to pay the price to unwind the pilfer.

The big problems afflicting Americans right now are inflation and interest rates. Corporations jack up prices which is the definition of inflation. And the Federal Reserve uses that as an excuse to raise interest rates.

The widespread inflation we see is mostly corporate greed. Let’s use gasoline as an example. Oil corporations continued to raise gasoline prices. People continued to pay the increased prices. They did not reduce their consumption substantially. The oil companies knew that Americans had money in their pockets from savings from doing less during the Pandemic and from relief from the federal government. And the oil companies legally stole that money with higher gasoline prices, aka inflation. Note that at no time did any American go to a gasoline station that had no gas. There was never a shortage. Because there was ample supply, gasoline prices should not have gone up. In fact, it is clear that as soon as oil companies perceived demand destruction, the term used to indicate a permanent consumer behavior change, buying less gasoline, the prices rocketed downward. I discussed this on the Muslim TV Network.

Corporations have pricing power. As such, they are ceded the ability to take our wealth. Supply and demand pricing only works for things we do not need. Competition for a needed resource is not enough because corporations inherently collude with each other to keep prices high to maximize profits.

And when irresponsible corporations are unwilling to do the right thing, the Federal Reserve penalizes the poor and middle-class by raising interest rates. It is yet another entity dipping into the pockets of Americans.

Inflation increases the price of products. Corporations’ profits increase because they ultimately sell fewer products for more money. Higher interest rates simply make the middle class and the poor’s debt much more expensive.

To summarize, corporations, in their infinite dereliction, offshored manufacturing, instituted just-in-time-inventory, and poor forecasting. Any disruption creates shortages. Those shortages provided cover to raise prices not only for items stuck in the supply chain but for products across the board.

First, the poor and middle class must pay for the ineptitude of the corporations. And second, to force corporations to stop raising prices, they throw the economy into a recession by taking money from the poor and middle class in the form of interest or loss of jobs. And who wins? The corporate executives and shareholders win in the long run.

There are solutions. We discuss many of these on our program Politics Done Right. Corporations have too much power. We must define a set of services and products deemed essential and remove the profit motive from them. The laisses fare pricing should be left to nonessentials. Some will balk because it’s different. But it will save us all from the greed that is inherent to our economic model.