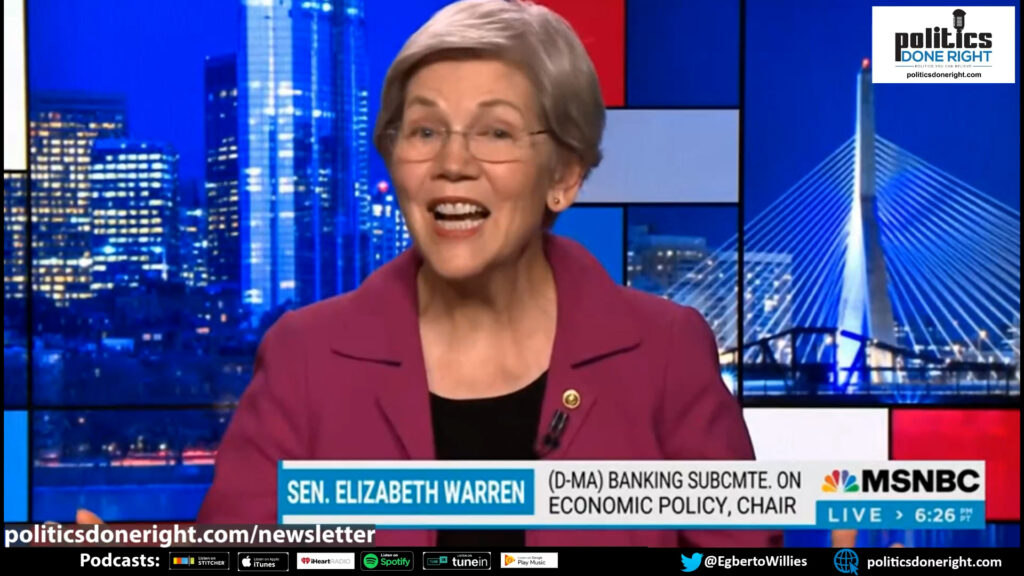

Senator Elizabeth Warren all but said I told you so as she itemized and blamed Silicon Valley Bank’s failure on bribed politicians, lousy regulators, and greedy executives.

Elizabeth Warren blames her colleagues & others for the Silicon Valley Bank collapse.

Elizabeth Warren continues to point out that three specific reasons caused the Silicon Valley Bank crash.

“The way to understand this crisis is it’s really got kind of three players in it,” Warren said. “The first is Congress and President Trump, who said, let’s weaken the regulation, which we’ve hit really hard.”

Warren then went hard justifiably at Fed Chair Jerome Powell.

“The second part is the regulators themselves, in particular the Fed, in particular, Jerome Powell, the chairman of the Federal Reserve Bank, who took that change in the laws. And boy, did he run with it,” Warren said. “In fact, he ran further than a lot of people even though the law let him in tailoring the oversight of those banks in order to make them as weak as possible. And by the way, just a little side note, I very much opposed his being renominated to the Federal Reserve Bank. And the reason was exactly this, what he had done by using the opportunities he had by the change in the law in 2018 to weaken bank regulations, in my view. He was just headed in the wrong direction, and that’s what made him dangerous in the position of Chair of the Fed.”

Warren then hit the executives for their ineptitude and greed.

“But then there’s part three, and that is those executives, those bank CEOs who lobbied hard to get this change in the law,” Warren said. “Those are the ones who, when the window opened, Wow. Were they ready to go? And they went out, and they decided to load up on risk. And why? They loaded up on risk because it made their banks more profitable. And that meant it made them have higher salaries. They got to rule over bigger banks. They got big bonuses. They brought in their friends, and they did all that by taking on more risk. And it worked. NCB increased its profitability over the last three years by 40%. two,”

Elizabeth Warren could not be clearer.

Viewers are encouraged to subscribe and join the conversation for more insightful commentary and to support progressive messages. Together, we can populate the internet with progressive messages that represent the true aspirations of most Americans.