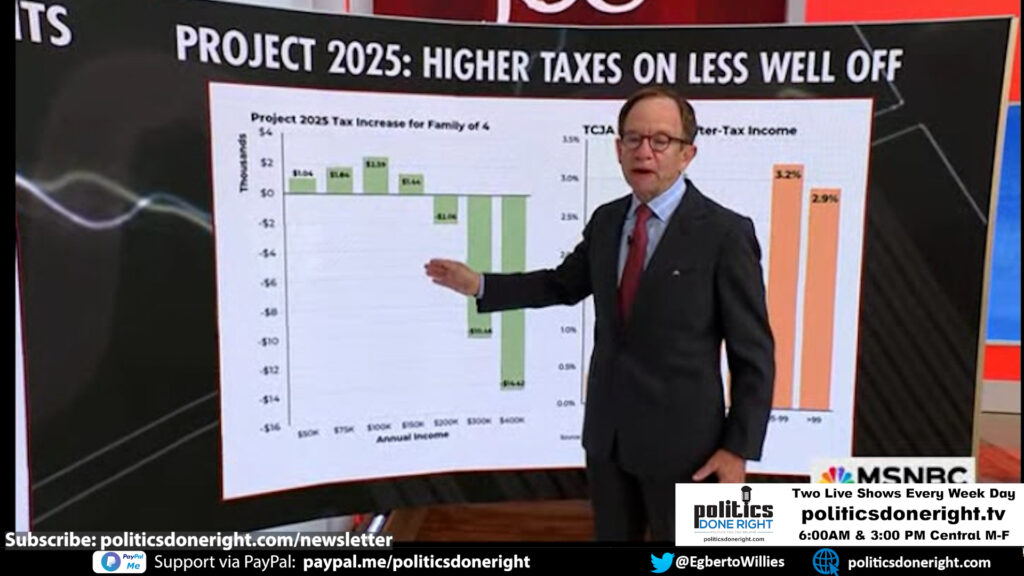

We point out that Project 2025 imposes higher taxes on the working class and middle class to pay for tax cuts for the rich.

Project 2025 = Higher Taxes For You.

Podcasts (Video — Audio)

Project 2025, heralded by its proponents as a visionary blueprint for America’s future, is, in reality, a calculated maneuver designed to exacerbate income inequality and burden the working and middle classes. This 920-page policy manifesto from the Heritage Foundation outlines a series of economic and financial proposals that would significantly shift the tax burden and financial responsibilities onto lower-income Americans while providing substantial tax cuts to the wealthy. Despite its proponents’ claims of fostering economic growth and stability, the project’s measures reveal an agenda to fortify the wealth transfer engine and widen the socioeconomic divide.

The Illusion of Economic Restructuring

Project 2025 proposes a radical restructuring of the tax system into just two brackets: 15% for incomes up to approximately $166,000 and 30% for those above. This simplification ostensibly aims to streamline tax policy, but the underlying impact tells a different story. This change translates into higher taxes for the vast majority of Americans earning less than the cutoff. Individuals earning $50,000 annually would see their tax burden increase, whereas those making $400,000 would enjoy a significant tax cut of around $14,000. This regressive tax shift starkly mirrors the Tax Cuts and Jobs Act (TCJA) of 2017, which overwhelmingly benefited the wealthy and corporations at the expense of the broader population.

Escalating the Student Loan Crisis

The Biden administration’s efforts to alleviate student loan debt have been met with staunch opposition from conservatives. Project 2025 seeks to undo these relief measures entirely, reinstating the financial strain on borrowers. For instance, the average monthly student loan payment for those with some college but no degree would rise from $78 to $308, significantly impacting individuals already struggling financially. This policy move is not just an economic blow but also a political one, disregarding the current administration’s substantial progress in reducing student loan debt.

Gutting Medicaid: A Threat to Public Health

Medicaid, a lifeline for millions of Americans, faces severe cuts under Project 2025. The proposal includes stringent work requirements and limits on the duration of benefits, potentially disqualifying up to 50% of enrollees in states like Virginia and Wisconsin. This reduction would devastate the healthcare system and disproportionately affect rural hospitals and nursing homes, which rely heavily on Medicaid funding. Contrary to the misconception that Medicaid serves only urban poor populations, it supports a broad demographic, including 38 million children nationwide. The proposed cuts threaten the healthcare access and quality for a significant portion of the population, including many who reside in traditionally conservative, rural areas.

Political and Social Ramifications

The push for Project 2025 highlights a stark disconnect between conservative policymakers and the needs of their constituents. Medicaid enjoys widespread bipartisan support, with 90% of Democrats and 65% of Republicans viewing the program favorably. Cutting such a popular and essential service jeopardizes public health and risks significant political backlash. The proposals within Project 2025 could alienate voters who are directly harmed by the cuts, undermining the political support conservatives seek to consolidate.

The Broader Conservative Strategy

The broader conservative strategy involves distracting the public from these regressive policies by focusing on divisive cultural issues and personal attacks on political opponents. The media narrative is often saturated with trivialities and sensationalism, diverting attention from substantial policy debates. For example, attacks on Vice President Kamala Harris’s personal life and professional record are used to overshadow discussions about the real economic impacts of Project 2025. Such tactics are designed to polarize and distract, preventing meaningful dialogue on critical issues affecting everyday Americans.

The Progressive Response

Progressives must counter this narrative by clearly communicating the detrimental impacts of Project 2025 and highlighting the tangible benefits of policies enacted under the Biden administration. Emphasizing real stories and data, such as the decrease in student loan debt per borrower and the widespread support for Medicaid, can help shift the focus back to substantive issues. Engaging with voters directly and debunking misinformation with facts and empathy will be crucial in mobilizing support against these regressive policies.

Conclusion

Project 2025 represents a significant threat to the economic stability and well-being of the working and middle classes. By increasing taxes on lower-income Americans, reinstating burdensome student loan payments, and slashing Medicaid funding, this policy agenda aims to consolidate wealth and power in the hands of the few. Progressives must expose these intentions, advocate for policies that promote economic justice, and work tirelessly to ensure that the interests of the many are not sacrificed to benefit the few. The fight against Project 2025 is a political battle and a moral imperative to protect the most vulnerable and ensure a fair and equitable society for all.

Viewers are encouraged to subscribe and join the conversation for more insightful commentary and to support progressive messages. Together, we can populate the internet with progressive messages that represent the true aspirations of most Americans.