One can only believe that a President governs with the values that are embedded in the recesses of his/her mind. It is for this reason that inasmuch as President Obama has been great for the 1%, the wealthy so far, they despise him with a vengeance. Most understand that in President Obama, a community organizer of meager beginnings who have lived among the deprived and the wealthy worldwide, likely has the ultimate goal of reversing the pilfering of the middle class if given a second term given some of the ground work that he has laid thus far.

One can only believe that a President governs with the values that are embedded in the recesses of his/her mind. It is for this reason that inasmuch as President Obama has been great for the 1%, the wealthy so far, they despise him with a vengeance. Most understand that in President Obama, a community organizer of meager beginnings who have lived among the deprived and the wealthy worldwide, likely has the ultimate goal of reversing the pilfering of the middle class if given a second term given some of the ground work that he has laid thus far.

Mitt Romney in turn chose a path of wealth not by deeds that enhanced society, but by enrichment through capital manipulation that materially affected the well-being of working Americans. As President his past is his prologue.

The New York Times article After a Romney Deal, Profits and Then Layoffs is a very important article that every middle class American must read and understand. America was once the nation of forced slavery. We have been atoning for that sin for decades.

Sadly, a sin affecting not just one race but an entire group of classes, the poor, the working class, middle class, and every class in between is being inflicted on us for all practical purposes with our approval. After-all it is we that have allowed the titans of finance to dictate the laws corporations are governed by and the legal capital extraction they can amass as profits. It is we who have decided that there worth as sales persons that trade in higher priced entities are worth more than our teachers, police officers, firemen, doctors, engineers, and all the other professions that make their jobs that ultimately produce nothing of material value possible.

Mitt Romney is the classic poster boy of a failed economic system that enriches a distinct few on the backs of the working middle class in the name of Capitalism. They choose to forget that Capitalism should be used as just one of many tools in a society to enhance the economy given the inefficiency of bartering and given that there are some things in our economy that demand a massive pool of financial resources.

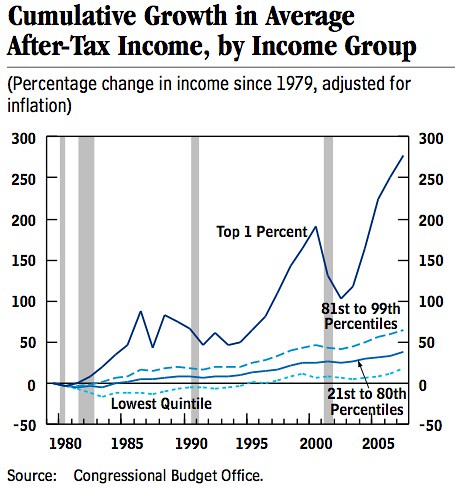

Mitt Romney like investment bankers throughout the world see Capitalism not as a tool to enhance civil society. They see society as a tool of Capitalism to increase their wealth. This is not conjecture. This is observable fact that every chart on our economy and wealth distribution corroborates. Case in point is the unnecessary destruction of the finances of many families through his company Bain’s purchase of Illinois medical company Dade.

NYTimes:

Bain and a small group of investors bought Dade in 1994 with mostly borrowed money, limiting their risk. They extracted cash from the company at almost every turn — paying themselves nearly $100 million in fees, first for buying the company and then for helping to run it. Later, just after Mr. Romney stepped down from his role, Bain took $242 million out of the business in a transaction that, according to bankruptcy documents and several former Dade officials, weakened the company.

Even some people who benefited from that payday and found it reasonable at the time now question it. “You would have to say, looking back, that it was too large, because it pushed us into bankruptcy,” said Robert W. Brightfelt, a former Dade president who collected more than $1 million.

That anyone would consider the brand of Capitalism that allows the unmerited extraction of capital from a company anything but legalized theft is astounding.Yet we are quick to allow those practicing these shenanigans to vilify the middle class and working class for their own attempt of wealth extraction however ill advised.

NYTimes:

Romney the candidate can still frequently sound like Romney the C.E.O. On the campaign trail, he has taken a tough-love approach to the economy, suggesting that the best remedy for the housing market is to allow foreclosures to “hit the bottom”; railing against wasteful spending by the government-backed solar company Solyndra; and arguing that companies with poor strategies, like General Motors, should be allowed to go bankrupt, without a federal bailout.

It was the same approach he took with Bain, as he explained in an interview with The New York Times in 2007, when asked about layoffs at the companies he bought.

“Sometimes the medicine is a little bitter,” he said, “but it is necessary to save the life of the patient.”

Note how easy it is for a titan of finance to force the bitter pill on the working middle class yet when titans of finance have found themselves in hard times it is the taxpayer that is asked to bail them out overtly and covertly. What is interesting is whether they have been successful in making money or not, somehow they are able to garner obscene bonuses.

NYTimes:

In 1995, Bain officials debated whether Dade should buy a competitor, a diagnostics division of DuPont Medical Products that owned technology vital to Dade’s future. Some Bain executives advocated quickly selling off Dade for a tidy profit. Others counseled patience, arguing that Bain could collect even more by investing in the company for a few years.

The business invested in and refined products, like a test that rapidly detects whether a heart attack has occurred, that became widely used. From 1995 to 1998, Dade’s annual sales rose to $1.3 billion from $614 million. Its assets grew to $1.5 billion from $551 million. But another number was climbing just as fast — Dade’s long-term liabilities, which surged to $816 million from $298 million.

Layoffs and Cutbacks

Cost-cutting became a mantra inside the company. After his employer, DuPont, was bought by Dade, William T. Mowrey, a field engineer, said his generous pension plan was replaced by a 401(k); his salary was cut by $1 an hour, costing him $2,000 a year in income. When he filed for overtime, he said, his new bosses refused to pay it. “They were just trying to milk as much out of us as they could,” he said.

Cindy Hewitt, a human resources manager, had been instructed to persuade about a dozen of Mr. Rosado’s co-workers to move to Miami, where Dade had another plant.

Not long after the workers arrived, the company said it would close that factory, too. Ms. Hewitt tried to help several workers return to Puerto Rico, but she said Dade insisted that they first repay thousands of dollars of moving costs. “They were treated horribly,” she said. “There was absolutely no concern for the employees. It was truly and completely profit-focused.”

What a company manufactures or its intrinsic value to society was of no interest to these titans of finance. Of even less value was the employees who from the specific actions of these titans of finance were considered less than indentured servants, or slaves. After-all the latter as property is generally maintained in operational state to prevent “capital loss”. They have made the worker nothing but a commodity to be traded or disposed of if no longer deemed valuable.

Tipping Into Bankruptcy

By 1998, Mr. Romney and his restless colleagues at Bain began looking for a way to cash out of the firm’s investment in Dade.

A hefty offer arrived. Kohlberg Kravis Roberts & Company, a rival buyout firm, proposed buying Dade Behring for $1.9 billion, according to documents filed in the bankruptcy case. But Bain executives rejected it, disappointed by the price, the documents indicate.

Bain settled on a common tactic in private equity: In April 1999, it pushed Dade to borrow hundreds of millions of dollars to buy half of Bain’s shares in the company — and half of those of its investment partners.

Bain pocketed the $242 million. Goldman received $121 million. Top Dade executives got $55 million, records show. The total payout to shareholders reached $420 million — nearly as much as the purchase price for Dade.

The money was hard to resist, acknowledged Mr. Brightfelt, the former Dade president. “We were all glad to get some cash out,” he said, “and we thought we deserved it.”

Even as the investors prospered, Dade cut 367 more jobs in 1999, documents filed with the Securities and Exchange Commission show.

The strategy of sharply increasing Dade’s debt alarmed several executives. Mr. Garrett, the former chief executive of Dade who stood to gain from the transaction, said he had argued unsuccessfully against it.

“It was too aggressive,” Mr. Garrett said. “It was done right up to the limit of what the company could borrow.”

With the amount of money that Dade owed to creditors and vendors at nearly $2 billion, some executives worried that the company would have little maneuvering room if its financial situation suddenly deteriorated.

Creditors, unsettled by deteriorating finances and high debts, began to pounce. More layoffs followed. And in August of 2002, Dade filed for bankruptcy protection.

The creditors threatened litigation against Bain and its investment partners, accusing them of “professional negligence” and “unjust enrichment,” according to bankruptcy documents. Bain and the other investors argued that the claims were baseless, but agreed to forgo about $68 million owed to them by Dade. And seven years after buying the company, Bain forfeited its remaining ownership stake.

In any other profession this would be considered theft. That the same people that disparage the welfare  queen and others that abuse our welfare programs would view this any other way shows a moral depravity that we have been taught is simply business.

queen and others that abuse our welfare programs would view this any other way shows a moral depravity that we have been taught is simply business.

It is time that this form of Capitalism is exposed for what it is.

It is time that we get back a free enterprise system that uses Capitalism as a tool and not visa-versa.

It is time that the rights of the individual supersede rights of corporations, investment bankers, and those that have been the driving force behind American’s income and wealth disparity,

|

My Book: As I See It: Class Warfare The Only Resort To Right Wing Doom Book’s Webpage: http://amzn.to/dt72c7 – Twitter: http://twitter.com/egbertowillies |

Viewers are encouraged to subscribe and join the conversation for more insightful commentary and to support progressive messages. Together, we can populate the internet with progressive messages that represent the true aspirations of most Americans.