*

The Tax Proposals in Plan B

The Tax Proposals in Plan B

- Raise only about $300 billion from high-income households – less than one third of the amount Boehner offered: Because it cuts incomes tax rates on the first $1 million of income and repeals tax expenditure limits for even the very highest earners, Plan B raises only about $250 billion from high-income households, less than one third of the revenues in the most recent Republican offer.

- Provide those making over $1 million average tax cuts of $50,000: The 0.3 percent of households with incomes over $1 million would get tax cuts averaging $50,000 per year.

- Lose about $400 billion in high-income revenue, relative to the Senate-passed middle-class tax cuts bill, with about 70 percent of the lost revenue going to households making more than $1 million: More than 90 percent would go to households with incomes over $500,000.

- Lose another $120 billion in revenue by providing million dollar tax cuts for the 3 in 1,000 wealthiest estates: Plan B makes permanent the current estate tax levels, which provide an average of more than $1 million in tax relief to estates worth more than $7 million, relative to the President’s proposal.

- Raise taxes by an average of $1,000 on 25 million working families with children and students: Plan B does not continue the American Opportunity Tax Credit and improvements to the Child Tax Credit and Earned Income Tax Credit.

- Fail to continue critical tax incentives for business, like the Research & Development credit, energy incentives, and temporary measures like bonus depreciation.

Other Consequences of Moving To Plan B Include

- Leaves in place a sequester that threatens education, research, and our national security.

- Pushes 2 million Americans off their unemployment insurance benefits starting in January. At Christmas time, Plan B would cut off benefits for 2 million workers searching for jobs, something Congress has never done before when unemployment was still 7.7%.

- Cuts reimbursements for doctors seeing Medicare patients by 27 percent.

THE TAX PROPOSALS IN PLAN B

Plan B would extend all of the 2001/03 tax cuts – including the reduced ordinary income tax rates and the lower dividend and capital gains rates – on the first $1 million of income and would repeal the pre-Bush tax expenditure limits – the Personal Exemption Phaseout (PEP) and the Itemized Deduction Phaseout (Pease) – even for households with incomes over $1 million.

- Plan B would raise about $300 billion from high-income households, based on a preliminary estimate. This is less than one third of the revenue offered by Speaker Boehner. It even falls short of the roughly $400 billion that would be raised from repealing all of the 2001/03 tax cuts for incomes above $1 million.

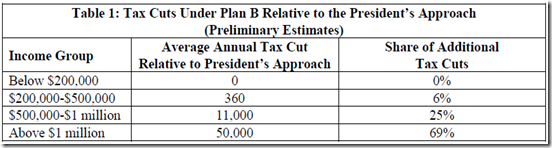

- Millionaires would get a $50,000 tax cut. The largest additional tax cuts under the Speaker’s plan would go to households with incomes above $1 million (the top 0.3 percent of households), who would get a tax cut on the first $1 million of their income, rather than the first $250,000 of their income, and would avoid reductions in tax benefits due to the PEP and Pease provisions. In contrast, the average tax cut for households with incomes between $200,000 and $500,000 would be $360. (See Table 1.)

- For this reason, 70 percent of the $450 billion lost by increasing the expiration threshold from $250,000 to $1 million goes to households making more than $1 million. More than 90 percent would go to households with incomes over $500,000.

- Provides a tax cut of $1 million per estate for the wealthiest 3 in 1,000 estates, all valued at more than $7 million per couple. Plan B would spend $120 billion over the next 10 years on additional tax cuts for the wealthiest 3 in 1,000 estate. The large majority of that amount would be spent on the 1 in 1,000 estates valued at more than $5 million.

- Less than 0.5 percent of the benefits of Plan B would go to business and farm estates valued at less than $5 million: The Tax Policy Center estimates that only 40 businesses or farms in the entire country that are valued at less than $5 million would owe any estate tax under the President’s proposal. Less than 0.5 percent of the additional tax cuts under the Plan B estate tax plan would go to these farms and businesses.

- Raises income taxes on 25 million middle-class families making less than $250,000 by an average of $1,000 apiece. This includes:

- College: Eliminates a tax incentive for college education for 11 million families, raising their taxes by an average of $1,100.

- Child Tax Credit: Reduces the refundability of the child tax credit for 12 million working families, raising their taxes by an average of $800.

- Earned Income Tax Credit: Eliminates the increase in the EITC for larger families and increases the EITC marriage penalty, together raising taxes on 6 million families by an average of $500.

- Fails to continue critical tax incentives for businesses. Plan B does not extend key provisions that Congress routinely passes with strong bipartisan support, such as tax credits for clean energy and the Research and Development Tax Credit. These incentives would all go away in both 2012 and 2013 under Plan B. In addition, Plan B would not extend the 50 percent bonus depreciation that was in effect in 2012 and is a cost-effective temporary measure to support investment and growth.

OTHER CONSEQUENCES OF PLAN B: LOSING UNEMPLOYMENT, CUTTING MEDICARE, CONTINUING UNCERTAINTY, AND ALLOWING THE SEQUESTER

- 2 million Americans would lose their emergency unemployment benefits next month. Plan B doesn’t extends emergency unemployment insurance (UI) for Americans pounding the pavement looking for jobs, meaning 2 million Americans would lose their benefits next month.

- A 27 percent cut in doctor’s pay in Medicare. Unlike the President’s plan, the House Republican Plan B does nothing to fix the Sustainable Growth Rate formula (SGR) or “doc fix,” continuing uncertainty for doctors and patients. Without a fix in this formula doctors will face a payment cut of 27 percent next year, or $14 billion. Reducing doctors’ payments by $39 million each day that is it not addressed would jeopardize the care for 50 million people with Medicare and unnecessarily destabilize the program.

- Continues to threaten default on our nation’s debt, heightening uncertainty for businesses and families. The House Republican Plan B continues to threaten default on our nation’s debts in order to achieve partisan goals. The full faith and credit of the United States of America is something we should cherish and should not be used as a bargaining tool by any side.

- Does nothing to replace the defense sequester, which will undermine national security with an 9 percent across-the-board spending cut. The President’s plan would replace the automatic 9 percent cuts to defense programs scheduled to take effect next year with a balanced package of responsible savings and revenue increases. Plan B continues to threaten our military with deep and poorly-targeted cuts.

- The Defense Department has already put into place a responsible strategy to reduce spending and strengthen our armed forces for the coming decade, resulting in $487 billion in cuts and adhering to the strict caps put in place in the Budget Control Act. The Defense Sequester would add an additional $500 billion in cuts.

- As Secretary of Defense Leon Panetta put it, “[Sequestration] is a blind, mindless formula that makes cuts across the board, hampers our ability to align resources with strategy, and risks hollowing out the force.”

- Leaves in place the 8 percent cut for non-defense discretionary spending, which would devastate key national priorities like research and education. Estimates from the Office of Management and Budget show that the sequester would cut domestic non-defense spending by about 8 percent. Over the course of a year, this would mean:

- About 100,000 children would lose access to Head Start.

- Some 10,000 special education teachers and related staff would be out of jobs.

- Close to 700,000 women and children would lose the nutrition assistance they need.

- And research and development, which is critical to long-term economic growth, would suffer profoundly, with about 700 fewer new grants from the National Institutes of Health and up to 1,500 fewer grants from the National Science Foundation.

Viewers are encouraged to subscribe and join the conversation for more insightful commentary and to support progressive messages. Together, we can populate the internet with progressive messages that represent the true aspirations of most Americans.