Patrimonial Capitalism

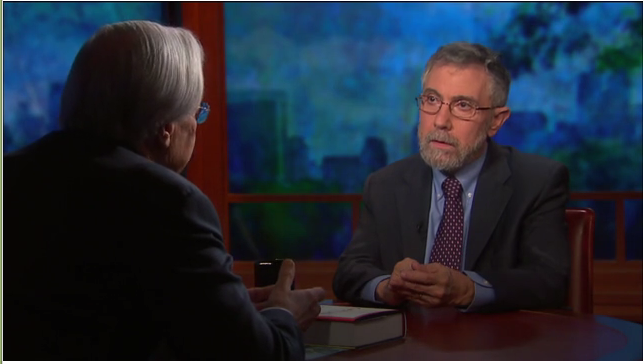

After watching Bill Moyer and Paul Krugman above, I purchased Thomas Piketty’s new book ‘Capital in the Twenty-First Century’. I covered much of what Paul Krugman and Bill Moyer said above in layman terms in several of my blogs and in my book.

“Here is Pikkety’s main point,” Bill Moyer’s said. “Capital tends to produce real returns of four to five percent and economic growth is much slower (2 to 3%). What’s the practical result of that?”

The result of that to a mathematical certainty is the economy in which we live today. I stated as much in a blog post I wrote a few months ago titled “Corporate Profits Under ‘Socialist’ Obama Double Reagan’s –Middle Class Under Siege.” In that post I said the following

It is a mathematical fact that if the wealthy’s income and wealth is growing at a faster rate than the wealth and income of the middle class in a virtually closed world economy, then it is being done at the expense of the middle class. In other words, the middle class is being robbed. The middle class is being pilfered. It has nothing to do with the wealthy being bad people. It is that politicians have created bad policy that have allowed an economic system of selected haves and “have nots” based on who has access to capital.

Governmental policy has allowed the hoarding of capital after the New Deal since the inception Reagan’s supply side economics. No one needs to guess what has occurred. It is found readily in the charts. Now that the hoarding of capital has reached an unsustainable rate, many on the Right would have citizens believe the country is broke and that even more sacrifices are required of the middle class. This is a false premise. America is not broke. It is being pilfered from within.

I went further in my book “As I See It: Class Warfare The Only Resort To Right Wing Doom” where I discuss the further negative implication of taxing capital gain at a lower rate than income from wages.

The disparity in how one’s money is taxed allows for those who are wealthy to increasingly accumulate ever increasing wealth at a faster rate than a working person. Why; because “income” from capital appreciation (that increase in stock value) is taxed at a much lesser rate than income from work. As such the investing person (likely the wealthier person) has more disposable income to reinvest than the working person. That is a formula that is not easily overcome.

Contrary to popular belief our tax system is engineered to keep the average worker always at a financial disadvantage to the investor. In other words our tax policy rewards those that move and manipulate capital over those who would do an honest day’s work.

It is not at all difficult to understand this reality; however with a Right Wing echo chamber that is good at conflating mutually exclusive issues, they have been able to convince a substantial number of Americans that the equitable taxing of wealth and the wealthy would be detrimental to our economy. Many Americans are likely willing to believe the fallacy because they naïvely believe that the American dream of anyone having equal opportunity to make it applies to them. Unfortunately under our current implementation of capitalism, the tenet that everyone has the same opportunity is nothing but a pipe dream.

If you are born poor in a poor neighborhood, you likely will attend an underfunded public school with substandard resources. A substandard education in one’s formative years is a high mountain to climb that most simply do not even attempt.

This is patrimonial capitalism by design.

I love the term patrimonial capitalism. Unfortunately the problem is much deeper than simply patrimonial capitalism. The entire financial system is geared towards the creation of patrimonial capitalism intentionally.

In our current economic construct, advancing financially for most is but a pipe dream. Comedian George Carlin says it best in his skit ‘The American Dream”. We must be the change lest we seal our fate. We must vote in 2014.

LIKE My Facebook Page – Visit My Blog: EgbertoWillies.com

Follow @EgbertoWillies