*

When President Donald Trump launches his tax cut campaign today in Missouri, he will no doubt repeat the Republican mantra that slashing the corporate tax rate will lead to more and better jobs. He has proposed cutting the statutory federal corporate tax rate from 35 to 15 percent, while House Speaker Paul Ryan has called for a 20 percent rate.

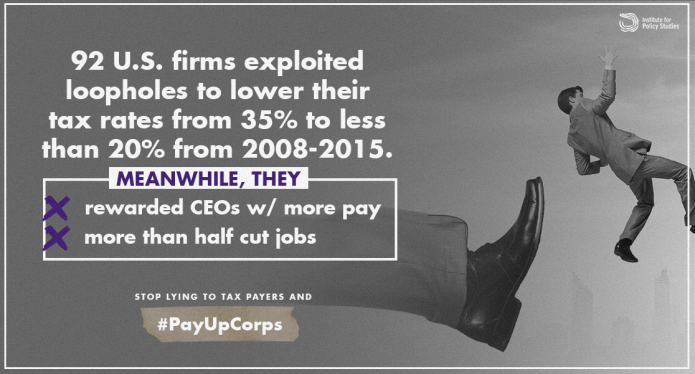

To investigate this jobs claim, the Institute for Policy Studies has analyzed the employment records of the 92 publicly held U.S. corporations that exploited loopholes to pay less than a 20 percent effective U.S. tax rate from 2008 through 2015, despite making a profit every year.

Key findings:

Tax breaks did not spur job creation

- America’s 92 most consistently profitable tax-dodging firms registered median job growth of negative 1 percent between 2008 and 2016. The job growth rate over those same years among U.S. private sector firms as a whole: 6 percent.

- More than half of the 92 tax-avoiders, 48 firms in all, eliminated jobs between 2008 and 2016, downsizing by a combined total of 483,000 positions.

Tax-dodging corporations paid their CEOs more than other big firms

- Average CEO pay among the 92 firms rose 18 percent, to $13.4 million in real terms, between 2008 and 2016, compared to a 13 percent increase among S&P 500 CEOs. U.S. private sector worker pay increased by only 4 percent during this period.

- CEOs at the 48 job-slashing companies within our 92-firm sample pocketed even larger paychecks. In 2016 they made $14.9 million on average, 14 percent more than the $13.1 million for typical S&P 500 CEOs.

Job-cutting firms spent tax savings on buybacks, which inflated CEO pay

- Many of the firms in our sample funneled tax savings into stock buybacks, a financial maneuver that inflates the value of executive stock-based pay. On average, the top 10 job-cutters in our sample each spent $45 billion over the last nine years repurchasing their own stock, six times as much as the S&P 500 corporate average.

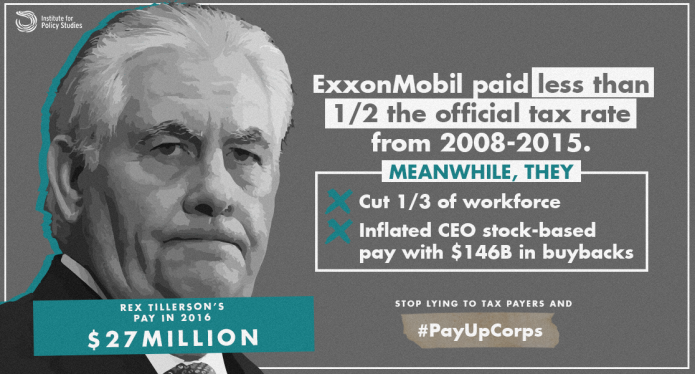

ExxonMobil hiked CEO Tillerson’s pay while dodging taxes, slashing jobs

- The oil giant paid an effective tax rate of only 13.6 percent during the 2008-2015 period, at the same time cutting more than a third of its global workforce (the company does not reveal U.S. jobs data). After pumping nearly $146 billion into stock buybacks, Exxon CEO Rex Tillerson, now the U.S. secretary of state, took home $27.4 million in total compensation in 2016, 22 percent more than he collected in 2008.

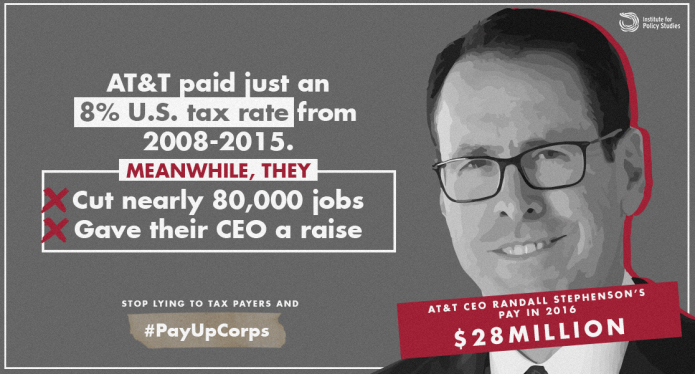

AT&T is the top job-cutter among the tax-dodging firms

- The telecommunications giant managed to get away with an effective tax rate of just 8.1 percent over the 2008-2015 period, while cutting more jobs than any other firm in our sample. After accounting for acquisitions and spinoffs, the firm had nearly 80,000 fewer employees in 2016 than in 2008. Instead of job-preserving investments, the firm shoveled profits into stock buybacks ($34 billion over the past nine years) and CEO pay. AT&T chief Randall Stephenson pulled in $28.4 million in 2016, more than double his 2008 payout.

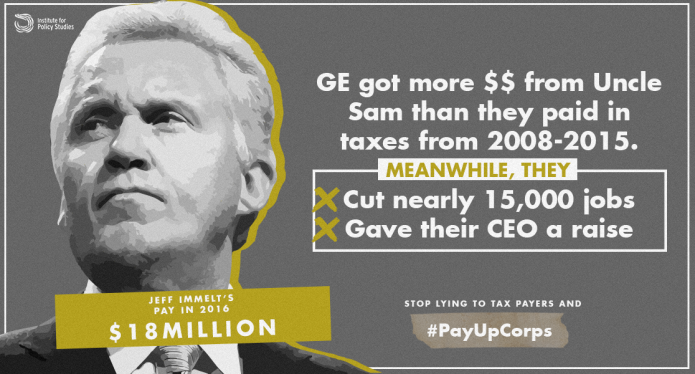

GE cut jobs while funneling offshore tax-dodging proceeds into CEO pay and buybacks

- Through extensive use of overseas tax havens, General Electric achieved a negative effective tax rate during the 2008-2015 period, meaning the firm got more back from Uncle Sam than it paid into federal coffers. The company spent $42 billion repurchasing its own stock, which helped boost CEO Jeffrey Immelt’s pay to nearly $18 million in 2016. Meanwhile, the company’s employee count dropped by about 14,700 over the past nine years.

“CEOs have used the proceeds from tax savings to enrich themselves at the expense of job-creating investments,” notes report author Sarah Anderson. “The debate over corporate taxes should focus on ensuring that the corporations these CEOs run pay their full and fair share.”

This 24th edition of the annual IPS Executive Excess series also includes the most comprehensive available catalog of CEO pay reforms, including proposed legislation to eliminate the CEO bonus loophole.

About the lead author: Sarah Anderson directs the Global Economy Project at the Institute for Policy Studies and co-edits the IPS web site Inequality.org. She has been the lead author on all 24 of the Institute’s annual Executive Excess reports. Her executive compensation analysis has been featured recently in the New York Times, Fortune, and the Los Angeles Times.

More Information:

Sarah Anderson, sarah@ips-dc.org, (202) 787 5227

Domenica Ghanem, press@ips-dc.org, (202) 787-5205

Jessica Pierre, jessicah@ips-dc.org

The Institute for Policy Studies (IPS-DC.org) is a multi-issue research center that has conducted path-breaking research on executive compensation for more than 20 years. IPS also provides a constant stream of inequality analysis and solutions through our Inequality.org web site and weekly newsletter.

Viewers are encouraged to subscribe and join the conversation for more insightful commentary and to support progressive messages. Together, we can populate the internet with progressive messages that represent the true aspirations of most Americans.