The rich did not get wealthy from their work or merit. Americans continue to be the raw material that they use. Here is how.

How we get screwed by the rich.

Watch Politics Done Right T.V. here.

Podcasts (Video — Audio)

Summary

The speaker exposes how U.S. tax, debt, and trade policies funnel wealth upward, arguing that Republicans slash taxes for the rich, borrow the shortfall from those same elites, and then force ordinary taxpayers to cover the interest, creating a hidden subsidy for capital while starving public programs. He warns that tariffs and media disinformation deepen the scam, hurting small businesses and obscuring the class war waged from above.

- Tax‐cut deception: GOP lawmakers pass top-heavy tax cuts, refuse to offset them with program cuts, and blow up the deficit.

- Bond-market siphon: Rich investors and foreign creditors buy Treasuries, collecting a trillion dollars in annual interest funded by workers’ taxes.

- Media complicity: Six mega-corporations dominate the news, downplaying corporate predation, such as Monsanto’s seed lawsuits, while perpetuating myths of “fiscal responsibility.”

- Tariff fallout: Trump’s 145 % duties on Chinese goods raise prices for small firms, threaten U.S. jobs, and still pad corporate profits.

- Rigged meritocracy: Capital gains enjoy lower tax rates than wages, DEI is scapegoated, and the “good-old-boy” network still decides who prospers.

In short, the host lays bare a system designed by and for the rich: corporations privatize gains, socialize risks, and weaponize media narratives to keep everyday Americans fighting over crumbs instead of demanding structural change.

Premium Content (Complimentary)

Corporate boardrooms and billionaire-funded think tanks have spent half a century perfecting a wealth-extraction machine. It works in four mutually reinforcing arenas—tax policy, the bond market, a concentrated media system, and a compliant political class—and it converts the labor of ordinary people into effortless rents for those who already own capital.

1 Tax policy: writing the rules that write the checks

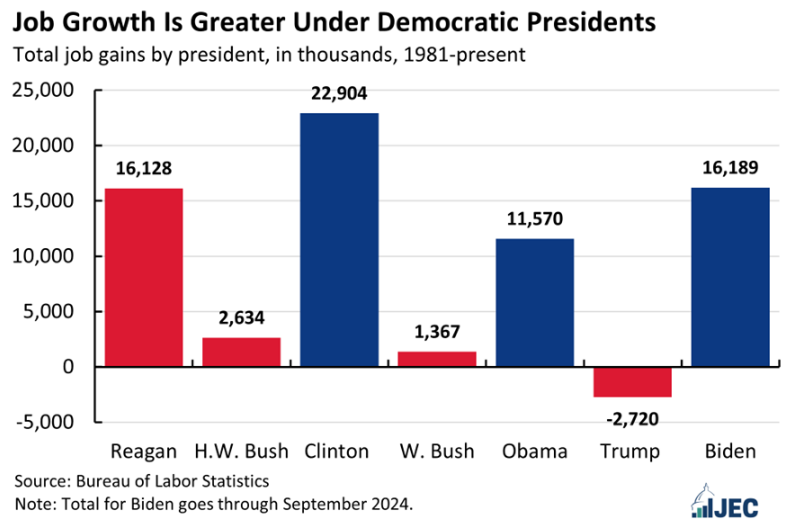

The data speak clearly: when Democrats hold the presidency, growth, jobs, and even deficits improve, while Republican administrations reliably explode red ink. A Joint Economic Committee analysis of the last seven presidencies reveals that Democratic chief executives have generated three times as many jobs as their Republican counterparts and experienced faster real GDP growth overall.

That divergence is ideological, not accidental. Conservative lawmakers slash top-bracket and corporate tax rates, insist those cuts “pay for themselves,” then leave popular programs intact because eliminating Social Security, Medicaid, or the VA would be electoral suicide. The result is a structural deficit that conveniently starves the government of revenue while showering high-income households with windfalls. Meanwhile, the 2017 Tax Cuts and Jobs Act intentionally preserved preferential treatment for long-term capital gains and qualified dividends; today, a billionaire pays just 20 percent (plus the 3.8 percent NIIT) on stock profits while a nurse can owe 37 percent on wages in the same bracket. The code is thus tilted not toward “merit,” but toward capital ownership.

Because Republicans seldom offset those giveaways, Democrats returning to power inherit fiscal wreckage and—out of mathematical necessity—raise some taxes. Predictably, right-wing media frame those moves as “class warfare,” even though they merely slow a revenue hemorrhage engineered to enrich those at the top.

2 Bonds: the quiet siphon

Congress plugs the revenue hole by issuing Treasury bonds. Who buys them? First and foremost, rich Americans and major foreign creditors, such as Japan, China, and collectively, Western European nations, now hold well over two trillion dollars of U.S. sovereign debt. Interest on this pile reached a record $1.2 trillion in fiscal year 2024, vaulting past the Pentagon budget to become the federal government’s third-largest line item. Every April, income tax receipts flow directly to those coupon payments before a single dime is allocated to schools or clinics. That mechanism amounts to a reverse wealth transfer: workers finance tax cuts for the 1 percent and then pay interest to them for the privilege.

The scam deepens once deficits accelerate. Investors demand higher yields—4.5 percent on ten-year paper last quarter, which further inflates debt service. In effect, bond markets discipline democracy, vetoing ambitious social spending even when popular majorities support it. And because the government cannot default without triggering a global economic crisis, the public remains a captive revenue stream.

3 Media: laundering plutocratic narratives

Ordinary voters would rebel if they understood this shell game, so the information ecosystem must be curated. Just six conglomerates dominate American media, piping identical talking points across broadcast, cable, and digital channels. Corporate newsrooms dutifully repeat deficit panic stories when Democrats propose child allowances, yet they spike coverage of lost revenue from capital-gains loopholes or overseas profit shifting. By manufacturing consent around “tax relief,” these outlets normalize upward redistribution while portraying any effort to tax wealth as radical.

The same gatekeeping helps bury stories like Bowman v. Monsanto, the Supreme Court case that upheld a biotech giant’s right to sue farmers who attempt to save seed, thereby forcing growers to purchase patented seed annually and funnel monopoly rents to shareholders. A media system beholden to advertising dollars has little incentive to highlight such corporate predation.

4 Politicians: brokers of the great transfer

Finally, elected officials—dependent on six- and seven-figure campaign checks—translate donor wish lists into statute. When former President Trump floated another multi-trillion-dollar tax cut in 2024, bond traders immediately signaled alarm, sending yields higher and threatening to blow up his economic case. Nevertheless, the proposal advanced because plutocrats expect to recoup any short-term turbulence through lower rates on their future estates and capital gains.

Trump’s concurrent 145 percent tariff on Chinese imports operates in a similar manner: publicly presented as a patriotic industrial policy, it quietly penalizes small businesses that rely on intermediate goods while favoring monopolistic firms with the market power to pass costs on to consumers. The tariff barnstorm illustrates how populist rhetoric masks policies that again privilege capital at the expense of labor.

5 Toward a counter-strategy

Progressives need not accept this rigged equilibrium. Congress can restore a genuinely progressive income tax, equalize capital-gains and labor rates, and impose a surtax on extreme wealth to disincentivize hoarding. It can close the carried-interest loophole, levy a small financial transactions tax, and use that revenue to reduce student debt and fund universal childcare—both high-multiplier investments that grow GDP faster than any supply-side cut has ever done.

On the bond front, refinancing long-term obligations at today’s still modest rates and allowing the Federal Reserve to hold a larger share of Treasuries on its balance sheet would keep interest payments within the public sector. Pair that with automatic stabilizers—such as a recession-triggered surtax on share buybacks—and the federal budget would become less hostage to market tantrums.

Finally, antitrust enforcement and public-interest journalism grants can crack media concentration, giving independent outlets room to interrogate economic orthodoxy. When citizens hear unfiltered facts—GDP outperforms under Democrats, deficits explode after GOP tax cuts, and interest checks go to the already rich—they tend to favor fairer rules.

In short, the mechanisms that allow the rich to extract value are neither natural nor inevitable. They are policy choices embedded in the tax code, the bond market, the media landscape, and the campaign-finance system. Exposing those choices—and the class interests behind them—is the first step toward reclaiming democracy’s promise that prosperity should flow from the many, not merely to the few, through public policy that transfers income upward. The evidence is neither abstract nor partisan; it is arithmetic embedded in Bureau of Economic Analysis tables, Treasury auction data, and CBO budget baselines. Conservatives can shout “fake news,” but they cannot repeal math.

A genuinely meritocratic economy would invert today’s incentives. It would tax capital gains at least as heavily as labor, impose a robust surtax on extreme wealth, and redirect borrowing costs from billionaire coupon-clippers into universal programs that build human capacity, such as child care, tuition-free public college, and Medicare for All. It would pair a Green New Deal with a high-road industrial policy that centers union labor and community ownership rather than subsidizing Exxon and Lockheed. And it would replace performative tariffs with cooperative global standards that protect workers and the planet, rather than benefiting billionaire trade cheats.

Corporate media hesitate to spell out this agenda because conglomerates profit from the status quo. They frame budget debates around “hard choices” rather than the apparent choice to tax concentrated wealth. They treat Trump-style tariffs as populist theater rather than a cash-grab that empties small-town storefronts. They parrot deficit alarmism only when Democrats propose child tax credits, not when Republicans pass yet another capital gains holiday. This omission is not merely an oversight; it is a manifestation of class solidarity among the boardroom elite.

The remedy, then, is not merely polite fact-checking alone, but movement-based politics that expose the scam and organize a democratic counterpower. When voters grasp that every tax-cut dollar eventually reappears as an interest-payment dollar—and that both flow to the same narrow investor class—the austerity narrative collapses. A mobilized majority can demand progressive taxation, slash military bloat, and invest in human flourishing instead of billionaire portfolios. That, finally, is the math corporate broadcasters never show on the evening news—because when the people see the ledger, they stop signing the blank check.

Viewers are encouraged to subscribe and join the conversation for more insightful commentary and to support progressive messages. Together, we can populate the internet with progressive messages that represent the true aspirations of most Americans.