*

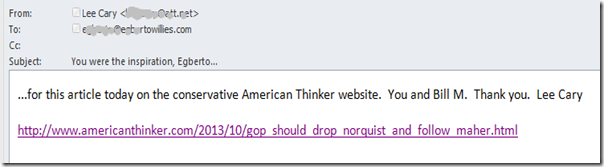

This morning I got a short email from someone I do not know but is apparently a writer at the Conservative magazine “American Thinker”.

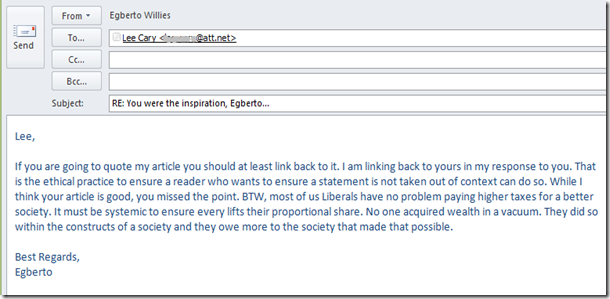

I read his piece and replied as follows.

American Thinker Lee Cary attempted to parody my piece “Bill Maher: Conservatives Will Bend Country Into California’s Image (VIDEO)”. In his piece “GOP Should Drop Norquist and Follow Maher” he writes,

American Thinker

Egberto Willies, commenter in the Daily Kos piece where Maher is quoted, wrote, “Republicans have always loved cutting taxes on both the backs of the working middle class and at the expense of exploding budget deficits to appease their plutocratic masters.”

The Republicans should link Maher’s equation – “cut spending AND raise taxes” – with Willies’ observation that Republicans love to pile the tax burden on the “working middle class” and take the initiative.

He then suggests three changes to the tax code.

1. Remove state income taxes as a deductable [sic] item from the federal tax code for those making over $500,000.

2. Remove city income taxes as a deductable [sic] expense from the federal tax code for those making over $200,000.

3. Remove real estate taxes as a deductible item for all those paying over $15,000 in property taxes.

He makes these suggestions noting that it would affect Blue States which generally have state & city income taxes. What Cary fails to understand is that most Liberals would go for those changes as long as loopholes for the corporate welfare state are also mitigated. Liberals would go for this if offshore tax shenanigans were made illegal.

America does not have a spending problem. America does not have an entitlement problem. The wealth and income disparity charts prove that. America has a problem with income and wealth gorging. Anyone who has a little knowledge of economics knows that the marginal propensity to consume of the working middle class is much larger than the wealthy and as such gorging progressively kills an economy. 1929 is probative.

Cary’s article may make a few Conservatives feel good. It may make them believe that Liberals have no interest in putting their dollars where their mouth is. Most Liberals will. American Thinker, start thinking.

[Update 1] Lee Cary did link to the article.

LIKE My Facebook Page – Visit My Blog: EgbertoWillies.com

Follow @EgbertoWillies

Viewers are encouraged to subscribe and join the conversation for more insightful commentary and to support progressive messages. Together, we can populate the internet with progressive messages that represent the true aspirations of most Americans.

I’m encouraged that Mr. Willies and I agree. That makes me want to think and write more along these lines. Our respective parties (although I’m an independent) can’t agree on much, but we agree that the rich need to pay a fairer share of their taxes, and, there’s more than one way of doing that then just raising the tax rate only. We all want wealthy Obama supporters to share the wealth with the middle class without tax loopholes.

Proven evolution requires cooperation assisting Mother Earth become healthier alongside creating a happier humanity.

Mr. Willies’ comments deserved something other than gibberish, Nick.

In 2006, the top 1% had a household income of $386,000:

http://www.nytimes.com/interactive/2011/10/30/nyregion/where-the-one-percent-fit-in-the-hierarchy-of-income.html?_r=0

In 2012, the top 1% had a household income of $383,000:

http://www.nytimes.com/interactive/2012/01/15/business/one-percent-map.html

In the first two years of the current economic “recovery”, the household income by the top 1% increased, while the household income of the 99% decreased.

http://economix.blogs.nytimes.com/2013/09/10/the-rich-get-richer-through-the-recovery/

http://en.wikipedia.org/wiki/Income_inequality_in_the_United_States

I’m not saying the Republicans would have done any better, but Obama’s policies dramatically favor the wealthy.

I’d like to be refuted on this.